Although the container shipping industry is gradually coming back to normal after two years of destabilization caused by the pandemic, the freight forwarding companies are still struggling with numerous hurdles. The port congestion, the sky-high fuel prices, the lockdowns in China and the war in Ukraine are just some of the factors that are still hindering normal operations. Nevertheless, on the brighter side, even though the sea freight shipping rates are still above the pre-pandemic times, there has been a substantial drop in the spot rates in 2022.

The challenges in the container shipping industry

As stated by Mrs. Rania Skouta, the operation Manager of Feroniki SA, Globalia member in Piraeus Greece, “I have to admit that in the past months we have faced many problems such as delays because of the situation in ports of Singapore, Gioia Tauro and Tekirdag where we ship cargoes frequently. Nevertheless, we have managed to overcome the crisis and continue serving our clients in the best possible way.”

Some of the ongoing problems in container shipping could result in a new supply chain crisis and rate fluctuations. For example, there is a high probability of backlogs of cargo piling up in the ports in China. In a situation like this, freight forwarders need to take extra precautions and keep all options open.

“The fall in the sea freight rates is welcome news for us. Nevertheless, there are still many challenges lying ahead of us. My teammates are working round the clock to keep tabs on the vessel’s availability and check if they meet the requirements of our clients. Additionally, we are checking the surcharges for each month and the percentages and BAF/CAF, etc, or if there is any PSS. Next, we are making sure that the vessel in question is available on the confirmed dates. Once all the work is done, we just secure the required equipment in time for the loading to meet the cut-off of the subject vessel with the confirmed rates. The rest is monitored by our team 24×7,” adds Mrs. Skouta.

She further points out, “Although the reduction of the rates is a great benefit for the shippers, we are still having to face problems relating to port congestion and equipment availability. The war in Ukraine and the lockdowns in China are further adding to the problems. For instance, many shipping lines have suspended services to/from Greece for several reasons. Moreover, finding equipment in the Far East is becoming a tricky affair primarily because of the local lockdowns.”

The drop in sea freight shipping rates

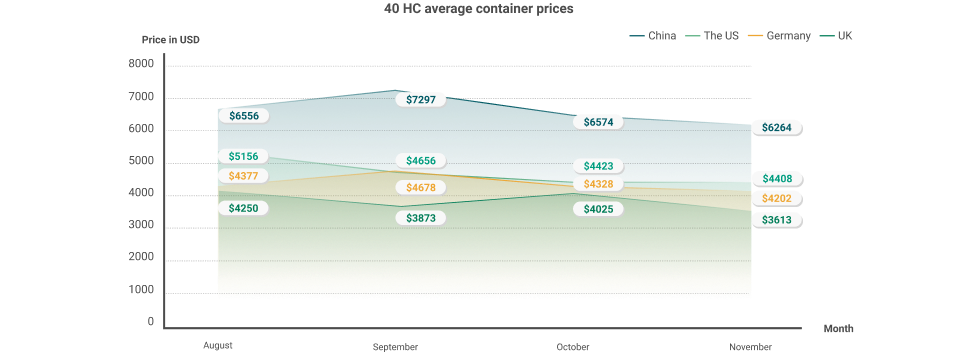

“Right now it is a good time for the ocean freight industry as rates are slightly decreasing. This will allow us to obtain more shipments and offer very competitive rates.” The steady decrease in sea freight shipping rates that started at the beginning of 2022 is still ongoing. The prices fell further in the lean season following the Chinese New Year. In the last two years, several factors hiked up the shipping cost. These factors included container and equipment shortage, port congestion, and insufficient workforce.

The average international spot rate decreased by almost 4 % at the start of April 2022. Shipping rates on the transpacific routes went down for the fifth week in a row. Freight rates to the US declined by around 6%-8%. Additionally, since April the overall sea freight rates have decreased by a whopping 12%.

Many industry experts are wondering if the decreasing rates is because of lower demand. Some are suggesting that it could indicate the revitalizing efforts of the industry and that there could be a sharp increase in capacity from the 3rd or 4th quarter of 2023.

Reasons behind the decreasing freight rates

The China factor

The decreasing volume of shipments following the peak during the Chinese New Year could be another important reason behind the price drop. Moreover, the lockdowns in Shanghai and other manufacturing centres in China are also a contributing factor. The normal functioning of the air freight industry could be another reason behind the declining prices.

The impact of the normal functioning of the air freight industry

During the pandemic a large number of passenger planes were grounded. As a result, forwarders couldn’t use the belly hold of the passenger flights for transporting shipments. This led to further pressure on the sea freight sector. The normal functioning of the air freight sector has freed up space for the ocean freight industry.

Changes in consumer demands

The two years of the pandemic witnessed a massive increase in consumer demands and e-commerce shopping trends. The spending pattern of the consumers has finally returned to the pre-pandemic level. The inflation and the rise in fuel prices around the world surely prompted consumers to cut down on spending. This obviously had significant consequences on space availability in the container shipping industry. More space availability definitely has helped to lower the freight rates.

“At the moment we are trying to make the best of the situation by further boosting our relationship with our partners, suppliers and customers. Years of steady cooperation is an important factor that has allowed us to continue providing our clients with dependable door-to-door transportation services. The flexibility and persistence of our team along with our longstanding connections, are some of the reasons why we are always able to support our customers with a range of solutions even in these uncertain times,” concludes Mrs. Skouta.

Globalia wishes Feroniki the very best for their upcoming projects!