Have you ever wondered why two identical products shipped to different countries are taxed differently, held up at customs, or even rejected outright? In the complex world of international shipping, small details can make or break a transaction—and few details are as vital as HS codes. In freight forwarding, HS codes (Harmonized System codes) serve as the backbone of customs clearance, tariff calculation, and global trade compliance. Yet, many shippers and forwarders underestimate their importance, only to face costly delays, penalties, or damaged client relationships.

In this blog, we dive deep into what HS codes are, why accuracy is non-negotiable, and how freight forwarders can ensure they’re getting it right every time. Whether you’re a seasoned logistics professional or new to the world of freight forwarding, understanding HS codes is essential to navigating international trade without roadblocks.

What are HS codes and why do they matter?

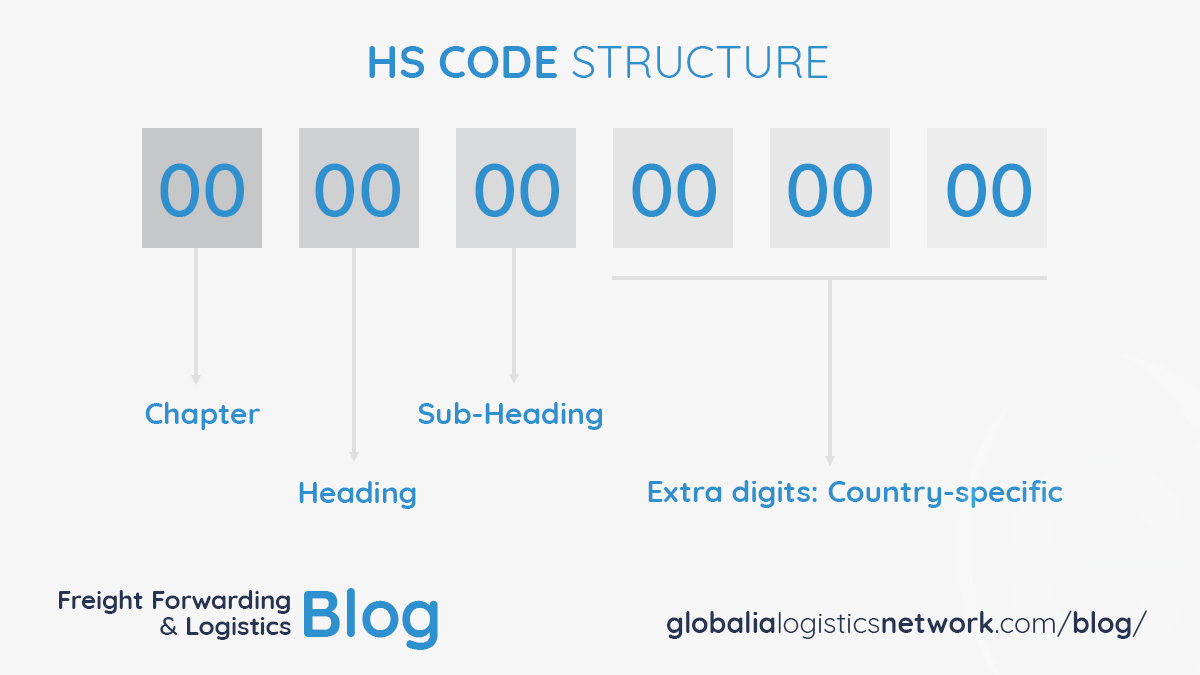

HS codes, or Harmonized System codes, are internationally standardized numerical codes used to classify traded goods. Developed and maintained by the World Customs Organization (WCO), the system comprises six-digit base codes that most countries expand into 8, 10, or even 12 digits to reflect national tariff rules and trade policies.

For example, a basic HS code like 8471.30 might identify a laptop, but in the United States it may be expanded to 8471.30.0100 to specify a duty-free classification, while in the European Union it could carry a VAT surcharge. These codes govern everything from how much duty is paid to whether a license or certificate is required—and are the very language that customs authorities speak.

In HS codes in freight forwarding, getting the classification wrong can lead to underpayment of duties (resulting in fines), overpayment (hurting profitability), or even cargo seizure. Simply put, the HS code determines the legal treatment of the product at borders. Misclassification is a red flag to customs agencies and could jeopardize your client’s reputation and your own.

The role of HS codes in freight forwarding documentation

Every key document in freight forwarding—from commercial invoices to packing lists to customs declarations—relies on the correct HS code. It’s how customs officers quickly understand what’s in a shipment and apply the relevant trade rules.

For instance, say you’re shipping LED lights from Germany to Brazil. Entering the wrong HS code could mean your shipment is classified as a general lighting system subject to higher duties, rather than as energy-efficient lights which may benefit from preferential rates or even exemptions under certain trade agreements. That tiny mistake could cost your client thousands of euros—or worse, see the shipment rejected entirely at the destination port.

That’s why HS codes in freight forwarding must never be guessed or pulled from online forums. They must be researched thoroughly, validated using official tariff lookup tools, and, when in doubt, verified with customs brokers or legal advisors.

How misclassification impacts customs and compliance

Customs authorities around the world rely on HS codes to enforce trade regulations, impose duties, and collect trade statistics. Misclassification can lead to three major issues:

-

Delays and Inspections – If the HS code doesn’t match the product description or supporting documents, customs officials are likely to flag the shipment for inspection. That means additional time, costs, and customer dissatisfaction.

-

Fines and Penalties – Deliberate or repeated misclassification can lead to hefty fines or revocation of import/export privileges. Some customs authorities treat misclassification as fraud, especially if it results in underpayment of duties.

-

Loss of Preferential Trade Benefits – Many trade agreements rely on HS codes to determine eligibility. A wrongly assigned code can disqualify a shipment from preferential treatment under agreements like EU-MERCOSUR, USMCA, or RCEP.

Accurate HS codes in freight forwarding are your insurance policy against these risks. Getting it right not only speeds up customs clearance but also protects your business and your clients.

How freight forwarders can ensure HS code accuracy

So, what can you do as a freight forwarder to guarantee the correct HS codes are being used?

Start by working closely with your clients. Shippers often assume that freight forwarders will handle HS code classification, but forwarders may not have full knowledge of the product’s material, function, or end use—all factors that influence the code. Encourage clients to provide product specifications, technical datasheets, and photos if needed.

Use authoritative sources and tools. Many customs websites and online platforms offer tariff lookup features. In the EU, TARIC (The Integrated Tariff of the European Union) provides a comprehensive HS code database. In the US, the Harmonized Tariff Schedule (HTS) does the same. Cross-check these resources regularly to stay up to date on changes, as codes can be revised or reclassified annually.

Also, consult customs brokers and trade consultants, especially for ambiguous products. If a product could be classified under more than one code depending on its use or composition, a professional ruling may be necessary to protect your liability.

Tricky cases: When HS codes are hard to define

Not all products fit neatly into predefined categories. Multi-function devices, electronic components, composite goods, or newly developed technologies often straddle several possible codes. This is where the General Rules of Interpretation (GRI) of the HS system come into play.

Let’s take an example: you’re shipping a smartwatch that functions both as a fitness tracker and a mobile communication device. Should it be classified under wearable tech, telecommunication equipment, or health monitoring devices? The wrong choice could not only affect duty rates but also the import permits and compliance documentation required.

As a freight forwarder, it’s your responsibility to flag these cases early and advise clients accordingly. When necessary, you can even apply for a Binding Tariff Information (BTI) decision, available in many jurisdictions, which provides legal certainty for the classification.

The growing role of technology in HS code management

In today’s digital logistics landscape, manual HS code entry is giving way to automated systems that integrate with TMS, ERP, and customs software. Artificial Intelligence and Machine Learning tools can now suggest HS codes based on product descriptions or historical data. While these tools increase speed and accuracy, human oversight remains essential—especially for sensitive or high-value goods.

HS codes in freight forwarding are now embedded in digital workflows and data exchanges. That means any mistake is replicated across systems: from warehouse inventory management to customs declarations to invoices. Ensuring the first entry is correct has never been more critical.

Conclusion: Make HS code accuracy a strategic priority

In an industry where time is money and compliance is key, HS codes in freight forwarding are not just technical details—they are strategic touchpoints that influence cost, speed, and legal risk. By understanding their importance, staying informed, and using the right tools and expertise, freight forwarders can turn HS code mastery into a competitive advantage.

Misclassification may start with a six-digit mistake, but it can end in lost shipments, unhappy clients, or regulatory trouble. Don’t let that happen. Treat HS codes with the precision they demand, and your international shipping operations will be smoother, faster, and far more reliable.