In today’s global supply chain ecosystem, sustainability is no longer a buzzword—it’s a benchmark. As environmental regulations tighten and companies face mounting pressure to reduce their carbon footprints, freight forwarders find themselves at the crossroads of logistics efficiency and environmental responsibility. One critical yet often overlooked component of this shift is Scope 3 emissions.

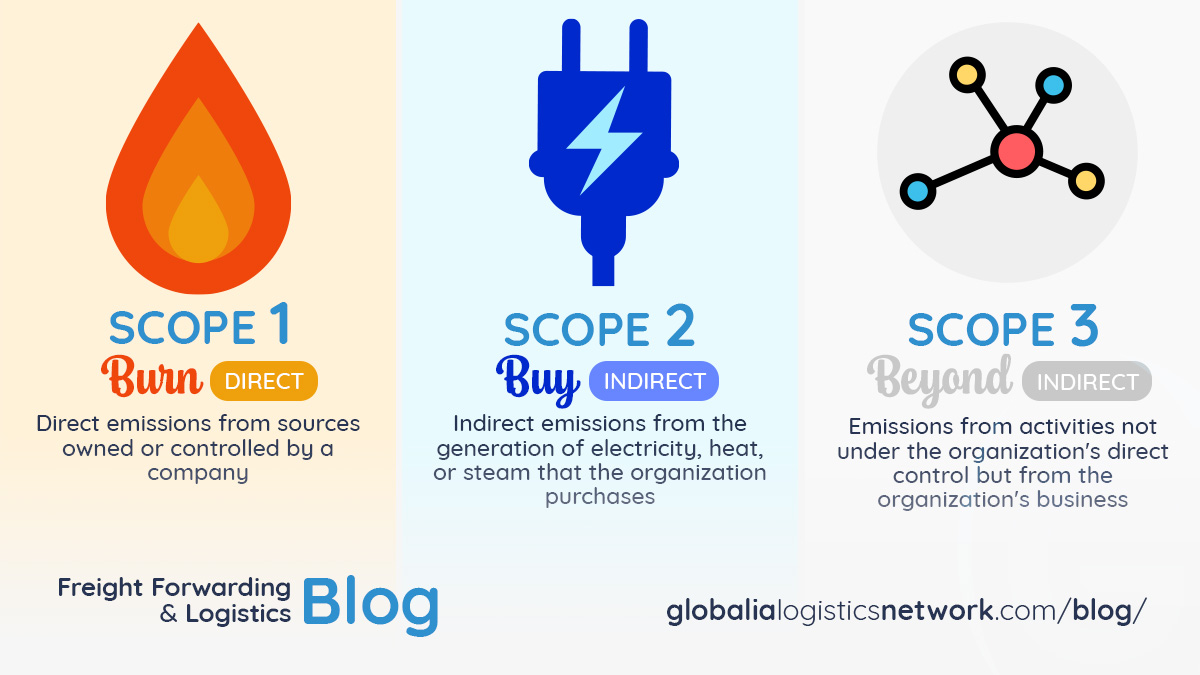

While most freight companies are already measuring and attempting to reduce Scope 1 and Scope 2 emissions—those directly from owned operations and purchased energy—Scope 3 emissions represent a far more complex challenge. These are the indirect emissions that occur across the entire supply chain, from the production of goods to their final delivery. And for freight forwarders, who are essentially the connective tissue of global trade, these emissions matter more than ever.

Understanding Scope 3 Emissions for freight forwarders

The Greenhouse Gas Protocol classifies emissions into three scopes. Scope 1 covers direct emissions from owned assets (like company trucks). Scope 2 includes indirect emissions from purchased electricity. Scope 3, however, involves all other indirect emissions in the value chain—and for logistics providers, this includes the fuel burned by subcontracted carriers, emissions from upstream suppliers, and even the end-of-life treatment of delivered goods.

Freight forwarders operate in the thick of this emissions web. They coordinate shipments, book cargo space on ships and aircraft, subcontract ground transportation, and orchestrate warehousing and last-mile logistics. As such, a significant portion of their environmental footprint comes not from their own operations, but from the partners and services they engage.

Why Scope 3 reporting is gaining ground

Governments, investors, and especially large multinational clients are now paying close attention to Scope 3 emissions. With the European Union’s Corporate Sustainability Reporting Directive (CSRD), the SEC’s climate disclosure rules in the U.S., and pressure from ESG-conscious investors, businesses across sectors are being required to disclose full-scope emissions—including those from freight and logistics.

This push has a direct impact on freight forwarders. Companies like Amazon, Unilever, and IKEA are demanding environmental transparency not just from manufacturers, but also from logistics partners. If you can’t account for and help reduce Scope 3 emissions, you risk losing contracts to greener competitors who can.

According to a recent Deloitte report, over 70% of multinational corporations have started evaluating the carbon footprint of their logistics partners. Freight forwarders who want to remain competitive in this environment must not only understand their Scope 3 emissions but also demonstrate active measures to mitigate them.

Customer expectations are shifting

The sustainability movement isn’t just being driven by regulations—it’s also being powered by customers. Businesses and consumers alike are prioritizing low-carbon options. Shippers increasingly ask for “green logistics” solutions: cleaner fuels, carbon-neutral delivery, emissions data for every shipment, and partners who align with their environmental values.

This changing demand profile means that carbon performance is now a key differentiator. Clients don’t just want low rates and fast delivery—they want sustainable logistics partners who can help them meet their own carbon goals. That’s where Scope 3 accounting becomes not just a reporting requirement, but a strategic business advantage.

How freight forwarders can begin tackling Scope 3 Emissions

The first step for forwarders is to map their emissions sources. This means understanding which parts of their operation fall under Scope 3. These typically include:

-

Upstream transportation services (such as subcontracted air, ocean, and road freight)

-

Warehousing not directly operated by the company

-

Packaging and materials sourcing

-

Fuel use from third-party carriers

-

Employee commuting and business travel

-

Disposal of delivered goods

Once these are identified, the next step is emissions measurement. While this can seem daunting, there are growing numbers of digital tools and calculators, some provided by organizations like Smart Freight Centre or GLEC (Global Logistics Emissions Council), that allow forwarders to estimate emissions based on weight, distance, mode of transport, and fuel type.

From there, forwarders can take concrete steps to reduce and manage these emissions, such as:

-

Partnering with carriers that use sustainable fuels (SAF, biofuels, LNG)

-

Offering route optimization to reduce empty miles

-

Consolidating cargo to reduce shipment frequency

-

Choosing intermodal options where possible (e.g., rail over road)

-

Encouraging green warehousing practices among partners

-

Offsetting carbon emissions through verified projects

By doing so, forwarders can not only reduce their environmental footprint but also offer carbon reporting as a value-added service to clients who are themselves under pressure to report and reduce Scope 3 emissions.

Embedding sustainability into the brand

Freight forwarders that take sustainability seriously are also reaping branding benefits. In a crowded logistics market, eco-consciousness can elevate a forwarder’s reputation. Whether it’s through green certifications, emissions transparency, or alignment with clients’ ESG goals, building a reputation as a sustainable forwarder opens doors.

Take for example, DHL’s GoGreen initiative or Maersk’s ambitious net-zero targets. These are now central to how those companies position themselves in the market. Smaller and independent freight forwarders can follow suit by joining green logistics networks, securing certifications, or offering carbon accounting tools to clients.

Additionally, by publishing annual sustainability reports or including ESG metrics in marketing material, forwarders can demonstrate that they are aligned with global efforts to decarbonize supply chains.

Looking ahead: A greener future for freight forwarders

The era of voluntary climate action is coming to an end. With regulations tightening and customers becoming more discerning, Scope 3 emissions reporting and reduction will become a standard part of doing business for freight forwarders. Those who act early will have a clear advantage—not just in compliance, but in winning customer trust and building long-term resilience.

Ultimately, caring about Scope 3 emissions is about more than environmental stewardship—it’s about business survival. The future of logistics belongs to those who can deliver not only freight, but also sustainability.